Blogs

Why I Love Art: The Art of Numbers

Kaavya Lakshman

A writer pens her love for tracking the Indian art auction market, and the thrill of finding record breaks, repeat sales and various market trends in the process.

As postgraduates studying at the National Museum Institute, New Delhi, we were greeted by sculptures big and small, ancient and medieval as we walked down the alley to reach class. Seeing their varied expressions, it was hard to begrudge the load on our shoulders on account of the books issued from what I consider the greatest library I have ever visited – the National Museum Library. During the admission interview I was asked, ‘which time period in Indian art history is your favourite?” I unhesitatingly answered “Modern Indian art.” This answer remained unchanged when I graduated after two years. It remains unchanged even today.

In college, iconography was compulsory to learn and stories such as that of Hamzanama commissioned by Mughal Emperor Akbar were fascinating; however, Modern Indian art, to me, went beyond aesthetics. The confident strokes with which Amrita Sher-Gil rendered her self-portraits, the trauma of witnessing post-Independence riots captured in Tyeb Mehta’s figurative paintings – contained within the frames were hints of the artists’ personalities and the tales of their lives.

As students of Art History, we often spent afternoons shuttling between paintings at the National Gallery of Modern Art, New Delhi, penning down the details we saw. At that moment, I appreciated art; I was intrigued by the skills the artists possessed. But it was only when I started my first job at Artery India, a sales advisory firm with the world’s largest database of Modern and Contemporary Indian art, did my relationship mature.

A typical day at work involved managing the aforementioned database, comprising auction results from across the world. I borrowed the eyes of a hawk to ensure I don’t miss a single auction sale featuring Modern and Contemporary Indian art. From then onwards, my association with art went beyond a mere spectator; there were no books guiding my views on a painting. Art turned into an asset, and I studied the market of Indian artists along with their practices. The highlight of being one of the few professionals tracking the Indian art auction market was the thrill of seeing numbers rise. There are two incidents I have fond memories of, when the art market started to make real, tangible sense.

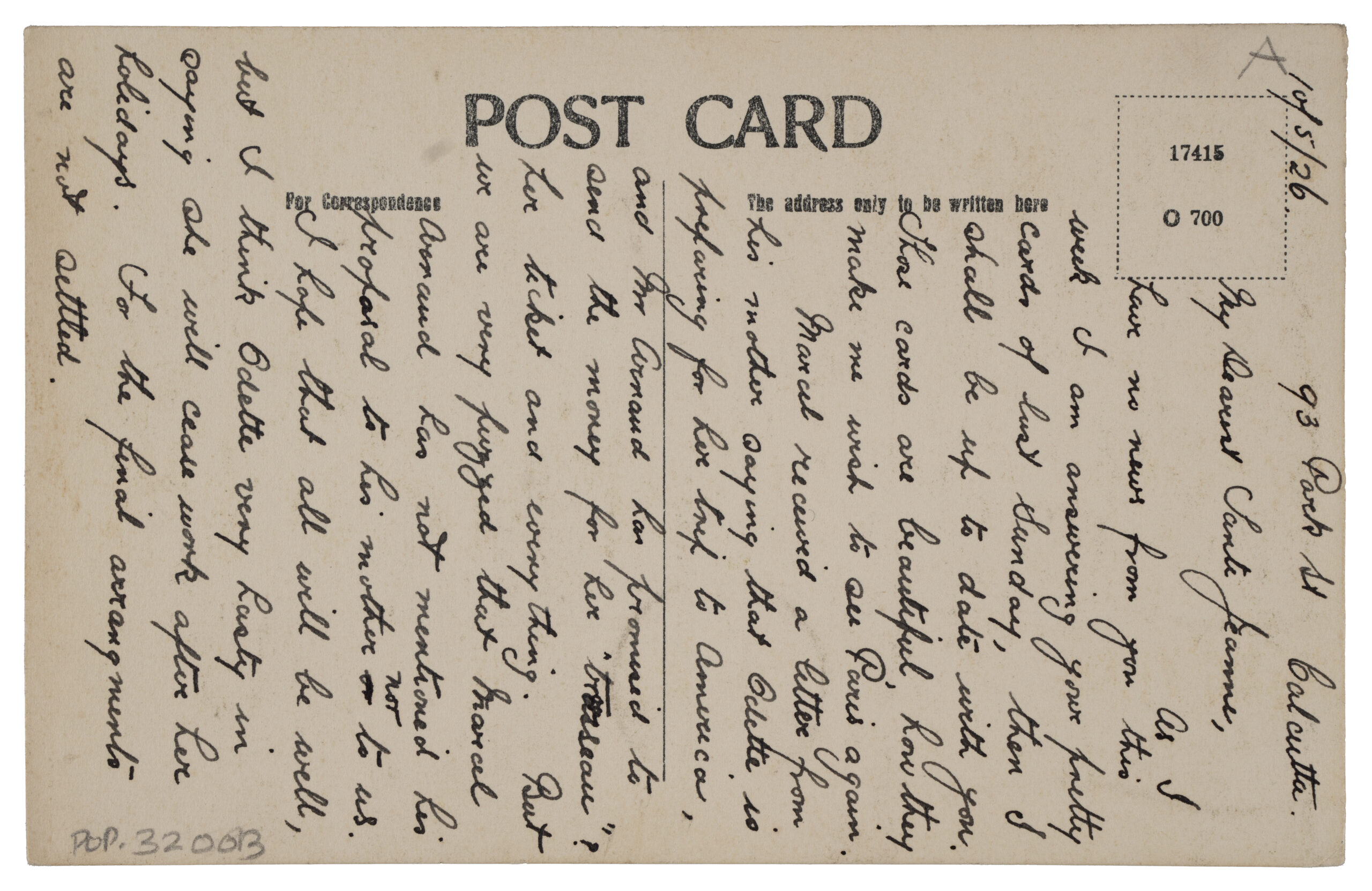

Shortly after I had joined, Amrita Sher-Gil’s The Little Girl in Blue went under the hammer at a Sotheby’s auction in November 2018. The painting sold for ₹18.6 crores, distinguishing it as Sher-Gil’s most expensive work at auction, at that time. I had discovered this fact as a novice trying to learn the ropes, with all the auction results of the artist loaded on a page before me. When I pointed this out to my manager, he introduced me to the event of a record break – when an artist achieves their personal best at auction. Every auction since, I kept a lookout, and sometimes my fingers crossed, for a ‘record break’.

Amrita Sher-Gil’s The Little Girl in Blue, sold for ₹18.6 crores by Sotheby’s. Image credit: sothebys.com

In the initial few months, I manually sifted through the entries of the database, as if to check that they have not run away. What I realised in the process was far more interesting – a single painting appeared more than once. This uncovered the concept of ‘repeat sales’ – when one artwork appears at auction more than once. Over time, I relied less on technology and more on my memory to point out repeat sales in auction catalogues.

These experiences, in isolation and collectively, were when I knew why I love art! The addition of numbers to an already engrossing world opened another dimension, wherein bar-graphs and market trends offer a measure of objectivity in what is considered a subjective topic.

Kaavya is making the most of her Master’s degree in Art History, and MBA in Marketing. She enjoys writing poetry, articles on art and culture, and is an avid reader.